I’ve been curious about why PnP Franchise stores are now underperforming. For years, these stores have been the bedrock of the PnP brand, and only 18 months ago – when new-new management stepped in – PnP executives were vocal about the entrepreneurial spirit of their franchisees, and their importance to the business.

So, what has changed since then to cause this segment to lag PnP Corporate Supermarkets’ like-for-like (LFL) growth by ~2.5%? Base effects from previously underperforming Corporate stores certainly play a role, but there must be more to the story.

We analysed the data, segmenting hundreds of thousands of real purchases across different PnP store formats. Specifically, we focused on PnP Family and PnP Express stores, which we estimate represent the bulk of the franchise grocery segment. By contrasting customer spending at these stores with PnP Corporate Supermarkets and other supermarket chains, we can empirically assess what has changed on the ground to drive the divergence in reported performance.

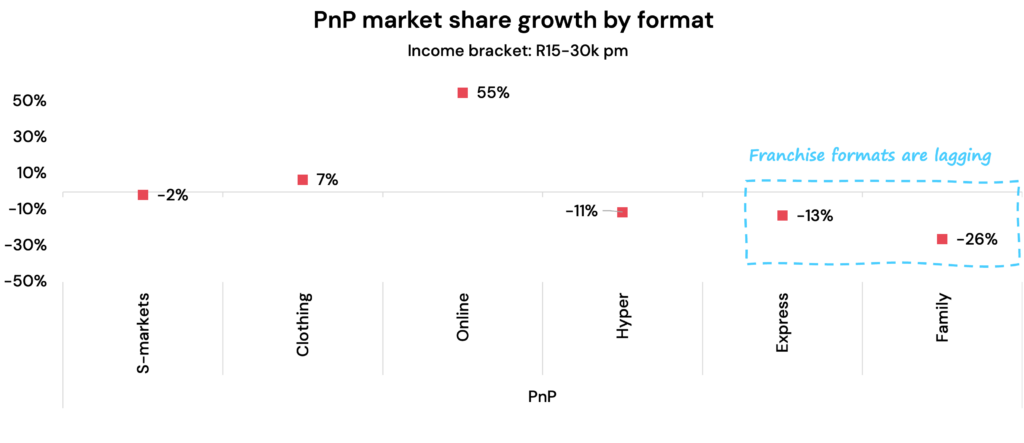

Improved performance from PnP Supermarkets, reported in recent company updates, is evident in our data. At the same time, our data confirms that Express and Family stores are underperforming relative to other PnP formats.

Why is this happening?

The data reveals a straightforward answer: fewer people are choosing to shop at these stores.

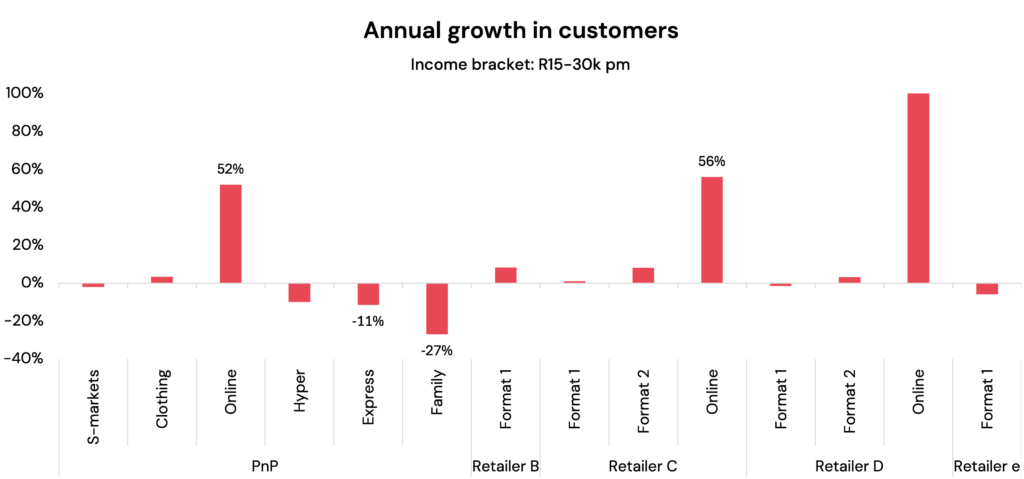

When we break down changes in customer growth – as per the chart below – it’s clear that the primary driver of underperformance is a decline in foot traffic. Fewer customers are visiting these stores to do their grocery shopping.

So, where are they shopping instead?

The likely answer is online.

Each major grocery retailer’s same-day delivery service is pulling in new customers. And since PnP Franchise formats are arguably more convenience-focused than other supermarket formats, it shouldn’t come as a surprise that they’re losing shoppers to online. Express stores are located in BP fuel station forecourts, and many Family stores are in smaller, suburban locations, which are all prime targets for online grocery delivery services.

Why is this analysis valuable?

- If the shift to online grocery delivery is permanent, PnP Franchise formats may face structural challenges.

- The data changes the conversation to understanding which retailers’ store portfolios are most exposed to the online migration for convenience purchases, rather than just considering market share shifts between retailers. Is it far-fetched to think that Woolies’ Engen stores may become the group’s Achilles?

- Traditionally, franchise stores have derived meaningful additional profits and differentiation from purchasing inventory outside the PnP’s loyalty supply chain – a model that may not align with a centrally-managed online ordering experience.

In summary, this may be an example of how deeper insights lead to even more questions about the second-order effects of the shift to online shopping for South Africa’s grocery retailers. While the trend itself is clear, the broader implications – on store formats, franchise models, and competitive positioning – are still unfolding.

This analysis shows the power of data to unpack and diagnose emerging trends that affect retailers and other consumer facing companies.